What Is Jungle Scout Competitive Intelligence

Jungle Scout’s Competitive Intelligence gives Amazon sellers and brand owners a close-up look at the competition. Instead of broad market stats, you get a granular view of the brands and ASINs that actually matter to you, so you can make smarter, data-driven moves to grow sales and market share.

Competitive Intelligence is built for action. It shows you exactly who you’re up against, what they’re doing to win, and how you can outmaneuver them with better keywords, sharper pricing, stronger listings, and smarter planning.

The Competitive Intelligence tool is a valuable addition if you’re scaling, want strategic edge, and are committed to using the data. But it’s not a silver bullet — the effectiveness depends heavily on how you leverage what you learn.

How it works

You define a “market segment” of up to 200 of your closest rivals. Start with your own ASIN (or a competitor’s) and the tool auto-builds the segment around lookalike products. From there, it tracks what really drives performance in your niche.

Core capabilities

Market share analysis

See where your brand stands on revenue, units sold, and reviews. Spot why you’re gaining or losing share and where to focus to win it back.Performance benchmarking

Compare your products to competitors over up to 12 months. Track sales and revenue trends, diagnose dips or spikes, and refine your strategy with real context.AI review analysis

Let AI comb through customer reviews across your products and your competitors’. Surface what shoppers love, what they hate, and the gaps you can exploit in listings, features, and ads.Keyword research

Uncover the revenue-driving keywords your competitors rank for in organic results and sponsored ads. Use those insights to optimize your listings and campaigns to capture more qualified traffic.Pricing strategy insights

Monitor competitor pricing patterns over time to set profitable ranges and build a dynamic pricing strategy that adapts to market shifts.

What It Does Well

Holistic view of market / competitors

Rather than just looking at individual ASINs, Competitive Intelligence aims to show broader market dynamics — who is winning, where share is shifting, and relative strengths across product mixes. For brands wanting to scale, that is a valuable lens.Benchmarking & gap analysis

Having side-by-side views of your listing vs. competitors (reviews, features, content) lets you spot weaknesses you might not have seen (missing features, weak reviews, pricing premium, etc.).Data infrastructure & reach

Jungle Scout is already one of the better-known tools in the Amazon seller space, with large datasets, which helps the Competitive Intelligence module start from a strong base of raw data. Many users cite it among the more “accurate” tools in Amazon research.Integrated into full-suite workflow

Because it’s part of the Jungle Scout ecosystem (product research, keyword tools, sales tracking, etc.), the insights from Competitive Intelligence can more easily feed into your product, listing, and advertising strategies — without needing to export/import between disjoint tools.Trend / historical view

You can see changes over time — shifts in market share, pricing, listing changes, etc. — rather than just snapshot views, which is critical for detecting moves by competitors before they fully manifest.

Who is Jungle Scout Competitive Intelligence For And How Does It Help?

Jungle Scout Competitive Intelligence is built for Amazon sellers, brands, and agencies that want clear, data-backed answers about their market and rivals. Instead of broad trends, it shows what your closest competitors are doing so you can make smarter moves, faster.

If you sell on Amazon and want fewer blind spots, Competitive Intelligence turns competitor activity into clear plays for growth. It helps you decide where to compete, how to position, and when to pull each lever across keywords, pricing, and product roadmap.

Who is it for?

Established Amazon sellers

Keep and grow market share. See whether a dip is seasonal, a competitor’s play, or an issue with your own listing, then respond with confidence.Growing brands

Benchmark against leaders. Borrow winning strategies, spot where you’re behind, and turn insights into a growth plan you can actually execute.New product launchers

Validate the niche before you spend. Identify the top players, their strengths, and how crowded the space is so you know if there’s a real gap to fill.Agencies and enterprise brands

Track competitors at scale. Optimize portfolios, inform omnichannel strategy, and align teams around a single source of Amazon truth.

How does it help?

1) Refines your market strategy

Get a clean view of the landscape for up to 200 competitors.

Diagnose sales swings – Is it seasonality, a rival’s promo, or your own stock or price change?

Benchmark performance – Compare revenue, units, pricing, ratings, and reviews to find the “why” behind changes.

Spot trends early – Catch emerging demand and seasonal waves so inventory and campaigns stay on point.

2) Improves listings and advertising

Turn competitor data into visibility.

Fill keyword gaps – Find valuable terms your rivals rank for that you’re missing.

Sharpen PPC – Prioritize high-converting keywords and cut wasted spend.

Upgrade content – Use AI review analysis to learn what customers love or hate and reflect that in titles, bullets, images, and A+.

3) Builds smarter pricing strategies

Price with context, not guesswork.

Track price patterns – See when competitors raise or drop prices around events like Prime Day.

Avoid price wars – Set sensible floors and ceilings that protect margin.

Win more Buy Box – Monitor who holds it and at what price to adjust without racing to the bottom.

4) Uncovers new product opportunities

Let the market tell you what to launch next.

Pinpoint gaps – Repeated complaints in competitor reviews often point to easy wins.

Plan launches – Understand price bands, seasonality, and must-have keywords before you commit.

Jungle Scout Competitive Intelligence Accuracy

Like any third-party Amazon tool, Jungle Scout’s Competitive Intelligence uses models to estimate what Amazon won’t share directly. It’s not 100% precise. That said, Jungle Scout points to its AccuSales™ algorithm as industry-leading and shows internal studies with a low margin of error. The takeaway: great for direction and strategy, but treat the numbers as estimates, not absolutes.

Competitive Intelligence is a strong compass for strategy and prioritization. Use it to see the field, compare yourself to rivals, and spot opportunities—then confirm the big moves with first-party data.

What to keep in mind

Sales estimates

How it works: AccuSales™ crunches billions of data points (including BSR) to predict sales.

Company claims: Jungle Scout’s 2024 comparison cites 84.1% accuracy (about 15.9% margin of error).

Competing claims: Helium 10 published its own 2024 test saying its estimates outperform Jungle Scout’s.

Real-world example: A Jungle Scout case study on its own products showed monthly estimates within 3.6% of Seller Central.

Keyword data

How it works: Competitive Intelligence leans on Keyword Scout for search volume estimates and an “Ease to Rank” score, modeling Amazon’s shifting search signals.

Competing claims: A 2024 Helium 10 study comparing search volume order to Amazon Brand Analytics reported Jungle Scout’s rank-order accuracy at 41.9% in that test.

Overall reliability

Dependencies: As a third-party tool, results can shift with Amazon’s algorithm changes and market behaviors that skew BSR and reviews.

Use it for trends, not certainties: It shines at direction, benchmarking, and spotting patterns across time.

Best practices to keep your decisions sharp

Cross-check critical calls: Validate big bets with your own Seller Central data and, when possible, a second tool.

Think in ranges: Plan best/base/worst scenarios instead of hinging on a single estimate.

Track over time: Compare weekly or monthly trends to smooth out volatility.

Corroborate keywords: Pair Keyword Scout insights with Brand Analytics where you have access.

Context matters: Layer in seasonality, price moves, stockouts, and promos before you act.

Jungle Scout Competitive Intelligence Plans and Pricing

Jungle Scout’s Competitive Intelligence isn’t a standalone tool you can grab on its own. It’s bundled inside the Brand Owner + Competitive Intelligence plan, which is the top-tier option for sellers. If you want access to Competitive Intelligence, this is the plan you’ll need.

If you’re just starting out, Jungle Scout’s lower-tier plans cover the basics like product research, keyword tools, and tracking—but they do not include Competitive Intelligence. If you are considering signing up you can get the best deal by choosing annual billing combined with our exclusive discount (automatically applied when you click the link).

Pricing

As of August 2025 (per Jungle Scout’s help center):

$149/month

$1,548/year (annual billing saves you money)

What you get with the Brand Owner + Competitive Intelligence plan

This plan unlocks the full Jungle Scout suite plus advanced features designed for established sellers and brand-focused teams.

Competitive features

Competitive Intelligence – Build custom market segments, analyze share and trends, and benchmark against rivals.

AI Review Analysis – Dig into competitor reviews to uncover customer preferences and product gaps.

Segment Creation – Includes a set number of segments for analysis, with the option to purchase more.

Additional upgrades

Multi-user access – Perfect for teams and agencies.

Expanded historical data – More depth in product tracking and keyword research.

Higher usage limits – Track more products, keywords, and listings than lower-tier plans allow.

Advertising & Analytics – Advanced PPC optimization and ad performance tools (via Seller Central connection).

Review Automation – Streamline review requests to boost feedback volume.

Who should choose this plan?

Ambitious sellers ready to scale and defend market share.

Established brands that need deep competitor insights to refine strategies.

Agencies and larger teams managing multiple accounts or clients.

Getting Started With Jungle Scout Competitive Intelligence

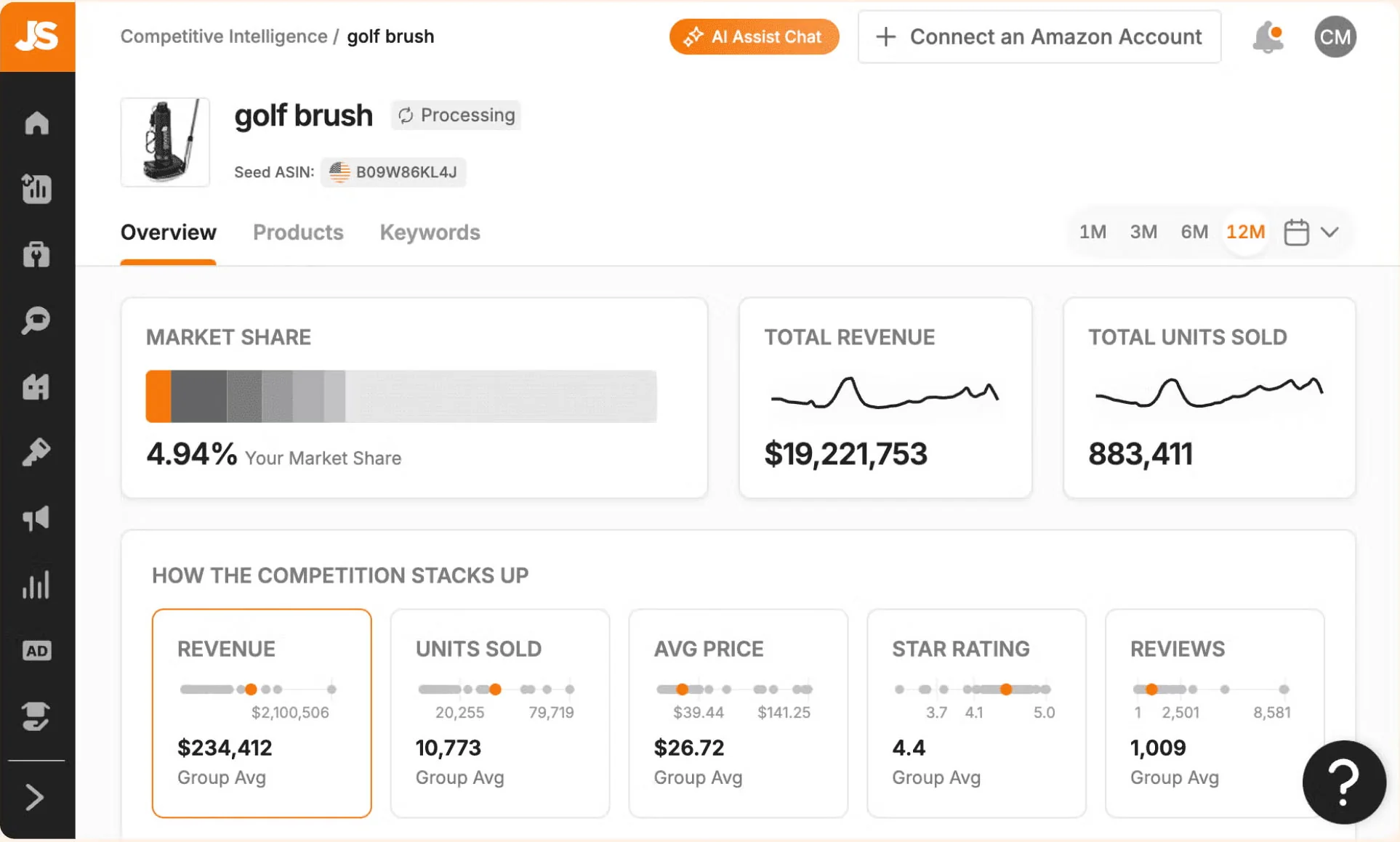

Competitive Intelligence starts with a smart market segment built from a single ASIN. Once your segment is ready, the dashboard tabs – Overview, Products, and Keywords – help you see where you stand, who you’re up against, and how to win. Build the segment, study the landscape, then translate the insights into listing improvements, smarter PPC, and tighter pricing.

Step 1: Create your competitive segment

Open the tool

From your Jungle Scout dashboard, open Competitive Intelligence and click “Create Segment.”Pick a product

Use one of your own ASINs by connecting Seller Central, or enter a competitor’s ASIN you want to track.Name it and build

Give the segment a name and click “Finish.” Jungle Scout will map up to 200 closest competitors based on keyword overlap.

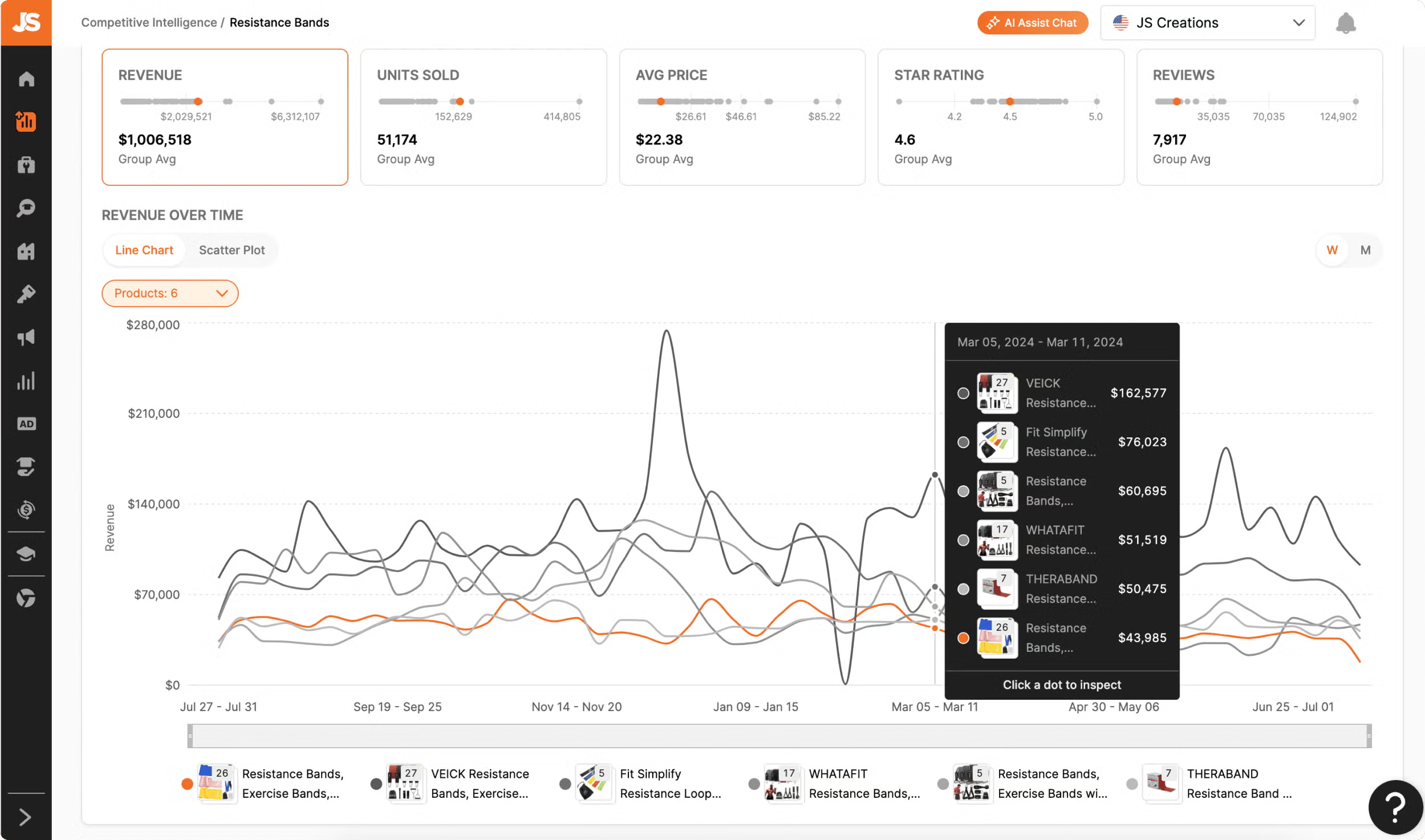

Step 2: Read the Market Overview

The Overview tab gives a 30,000-foot view with up to 12 months of history.

Benchmark performance – Compare your revenue, units, price, ratings, and reviews to the overall market.

Visualize share – Use the scatterplot to see how your product stacks up against others at a glance.

Gauge market health – Look at total market revenue and unit trends to spot seasonality and growth waves for inventory and promo planning.

Step 3: Compare specific products

Dive deeper in the Products tab.

Identify key rivals – Use filters or the “Closest competitor” feature to zero in on who matters.

Pin for side-by-side – Pin up to six ASINs to track them across charts and tables.

Mine reviews for signal – Run AI Review Analysis to learn what customers love, what they hate, and where you can outdo competitors.

Step 4: Refine your keyword strategy

Turn competitor data into visibility in the Keywords tab.

Uncover opportunities – Find high-revenue and missing keywords your rivals rank for that you don’t.

Track ranks over time – Monitor organic and sponsored ranks for you and competitors.

Feed PPC smartly – Target proven competitor keywords, prune waste, and protect branded terms.

Best practices

Start with your flagship – Build your first segment around a best seller or most strategic ASIN.

Think in trends, not snapshots – Use the full 12-month view to avoid reacting to one-off spikes or dips.

Ask better questions – If a rival’s sales jump, check price drops, promos, stock changes, or listing updates.

Benchmark for growth – Revisit your segment regularly to see if you’re gaining or losing share and why.

Market and Trend Analysis

Competitive Intelligence helps you zoom out and see the bigger picture. By tracking market-wide metrics, diagnosing sales swings, and spotting seasonality, you can plan smarter and place better bets for your product’s future.

Use Competitive Intelligence to understand the market’s rhythm, then turn those patterns into inventory, pricing, and PPC plans you can execute with confidence.

1) Analyze the high-level market overview

Once you build a competitive segment from your ASIN, open the Overview tab for a 12-month snapshot.

Gauge market health – Look at total market revenue and total units to see if the niche is growing or cooling.

Spot the major players – The scatterplot maps every product in your segment so you can see who’s big, who’s rising, and where you sit.

Check share concentration – A few dominant brands usually means tougher head-to-head competition. A fragmented field often means more room to win.

2) Evaluate seasonal trends

Historical data tells you when demand peaks and dips.

Plan for peak seasons – Stock up and increase ads ahead of holidays or predictable spikes.

Separate seasonality from product issues – If the whole market dips, it’s likely seasonal. If the market rises but you’re flat, dig into your pricing, content, or stock.

3) Diagnose sales fluctuations

Figure out what actually moved the needle.

Competitor moves vs market shifts – Compare top rivals against the market curve to see if a promo, price drop, or stockout caused changes.

Benchmark for context – View your revenue, units, and price next to segment averages so you’re reacting to signal, not noise.

Best Practices

Analyze pricing trends – Review historical price movements across the segment. If competitors discount during certain windows, build that into your plan without triggering a race to the bottom.

Pair trends with AI Review Analysis – If sales dip market-wide, scan recent reviews on top products to spot quality issues or feature gaps you can improve.

Find untapped niches – Use Opportunity Finder to surface high-demand, low-competition ideas, then validate positioning, price bands, and must-have keywords with Competitive Intelligence.

Optimize listings with Competitor Keyword Data

Jungle Scout’s Competitive Intelligence gives you a clear path to reverse-engineer how competitors win search — so you can fill your own keyword gaps, tighten SEO, and ship stronger listing copy. Competitive Intelligence shows where competitors win on keywords. Pair that visibility with Keyword Scout, AI Listing Builder, and Rank Trackerhttps://projectfba.com/jungle-scout-rank-tracker/, and you’ve got a tight, repeatable workflow for turning insights into rankings and revenue.

Using the Keywords tab

Once your competitive segment is set, head to the Keywords tab. You’ll see four buckets that make prioritization easy:

Winning – Keywords where you outrank competitors.

Opportunities – You rank, but there’s room to climb relative to rivals.

Weak – You’re trailing competitors and need relevance work.

Missing – High-value terms competitors rank for that aren’t in your listing yet (often the biggest wins).

Step-by-step optimization tactics

1) Identify Missing and Weak keywords

Start with Missing and Weak.

Filter for impact – Sort by search volume to surface the terms most likely to move traffic and sales.

Integrate naturally – Add relevant “Missing” keywords to titles, bullets, and descriptions using plain, customer-first language (not keyword stuffing).

Reinforce weak terms – Weave priority “Weak” keywords more prominently into copy and images/A+ where relevant to boost relevance and rank.

2) Run a multi-ASIN reverse lookup

Go deeper with Keyword Scout.

Choose competitors – Grab 5–10 top ASINs from your segment.

Analyze overlap – Drop them into Keyword Scout to reveal the terms multiple competitors rank for. Repeated overlap usually signals must-have keywords for your niche.

3) Build better copy with AI Listing Builder

Turn your short list into conversion-ready content.

Import keywords – Pull in your vetted list from Competitive Intelligence/Keyword Scout.

Generate and refine – Let the AI draft titles, bullets, and descriptions, then edit for clarity, brand voice, and uniqueness.

Watch the score – Use the optimization score as a guide while you polish.

4) Use backend keywords for the leftovers

When a valuable term doesn’t fit cleanly into customer-facing copy:

Add to backend search terms in Seller Central to capture relevance without cluttering the listing.

5) Track performance with Rank Tracker

Close the loop by measuring results over time.

Monitor organic and sponsored rank for your new and upgraded keywords.

Adjust quickly – If a term stalls, tweak copy, imagery, or bids, and reassess competitor moves.

Fine-tune Your Pricing Strategy

Competitive Intelligence helps you price with intention. Instead of reacting to every competitor move, you’ll use historical data to set smart ranges, protect margin, and win more often without a race to the bottom. Let the data set your pricing guardrails, then make precise moves when the market shifts. You’ll defend margin, earn more Buy Box time, and grow share without constant reactionary cuts.

1) Analyze historical pricing trends

The dashboard gives you up to 12 months of pricing history for your segment.

Identify seasonal patterns: Watch how prices shift around holidays, Prime Day, back-to-school, and other peaks so you know when to promote, hold, or raise.

Observe competitor behavior: In the Products tab, compare your price history against up to six close rivals and correlate their price moves with sales performance.

Diagnose sales swings: If a competitor’s sales jump, check whether a price drop triggered it. Decide whether to match, hold, or wait it out if the discount looks temporary.

2) Set profitable price ranges

Build a range that balances competitiveness and margin.

Establish floors and ceilings: Use market data plus your costs to define a healthy pricing band. Spot opportunities for premium positioning when the market can bear it.

Consider value-based pricing: If you offer better features, quality, or reviews, Competitive Intelligence and AI Review Analysis can validate a higher price point and help you message that value.

Avoid reactive undercutting: Track trends, not blips. Maintaining your value proposition through temporary price wars often protects profit without losing long-term share.

3) Monitor Buy Box performance

When multiple sellers share a listing, the Buy Box is the ballgame.

Track who’s winning and at what price: If a rival consistently edges you out by a small amount, a slight adjustment may capture more sales without gutting margin.

4) Leverage automated repricing

If you manage a larger catalog, automate the rules you’ve defined.

Automate based on insights: Competitive Intelligence doesn’t reprice for you, but it supplies the data to set rule-based strategies in your repricer.

Use near real-time inputs: Feed competitor movements and your price bands into your tool so you stay competitive without manual babysitting.

5) Plan pricing for new products

Carry these insights into your next launch.

Research adjacent niches: Build a segment for the target category and study top competitors’ price histories to choose a smart entry price.

Assess pricing power: Combine Competitive Intelligence with AI Review Analysis to see which features command a premium and how sensitive buyers are to price changes.

Diagnose Sales Fluctuations

Competitive Intelligence gives you the evidence you need to explain sales dips and spikes. Instead of guessing, you can separate market-wide trends from a single rival’s play and fix the right problem, fast. Diagnose from wide to narrow. Validate the market trend first, then pinpoint rival actions, listing quality, and keyword visibility. You will move from reactive fixes to confident, targeted changes that restore momentum.

Step 1: Start with the Market Overview

Begin in the Overview tab for your segment.

Check market trends – Look at total revenue and units for the niche. If the whole market is sliding, it is likely seasonality or a demand shift, not just you.

Isolate seasonal factors – If your decline mirrors the market, plan inventory and campaigns for the next peak. If the market is flat or rising while you drop, dig deeper into competitor actions.

Step 2: Analyze competitor movements

Head to the Products tab to compare apples to apples.

Pin top competitors – Select your 5–6 closest rivals and view their charts alongside yours.

Compare key metrics – Watch for sudden jumps in a competitor’s revenue or units and correlate with price and reviews.

Spot promos and listing changes – A sharp price cut often signals a promotion. A sustained lift after new images, A+ content, or title changes hints at a listing upgrade you may want to match.

Step 3: Deep-dive with AI Review Analysis

Qualitative signals explain why numbers moved.

Track sentiment shifts – If a competitor surges, recent positive reviews may reveal the feature or message that clicked.

Expose weaknesses – Repeated complaints point to gaps you can exploit with product tweaks or stronger positioning in your copy and visuals.

Step 4: Examine keyword performance

Confirm whether search visibility is the culprit.

Use the Keywords tab – Check whether rivals gained ground on important terms and whether you slipped.

Pair with Rank Tracker – Monitor your organic and sponsored ranks over time to see if lost positions align with the sales drop.

Identify lost traffic – Review Missing and Weak keywords to find terms competitors now dominate that you do not.

Best Practices

Rule out seasonality in the Overview tab.

If the market is steady, compare against pinned rivals in Products to spot price moves, promos, or listing upgrades.

Use AI Review Analysis to confirm what customers responded to.

Check Keywords and Rank Tracker to verify any ranking losses or competitor gains.

If nothing external explains it, audit internal factors like stockouts, suppressed listings, pricing errors, or ad budget shifts.

Improve Products And Discover New Opportunities

Competitive Intelligence helps you turn competitor data into action. By mining reviews, benchmarking key metrics, and pairing insights with other Jungle Scout tools, you can upgrade existing products and spot your next winning niche.

Competitive Intelligence shows you what customers want, what competitors changed, and where the market is moving. Use those signals to improve your current product today and to place your next product bet with far more confidence.

Improve existing products

1) Analyze competitor reviews with AI

Use AI Review Analysis to translate customer feedback into a punch list.

Identify pain points – Look for repeated complaints to guide fixes. If buyers say a rival’s water bottle leaks, improve your seal and call it out in your copy.

Uncover preferences – Note what customers consistently praise. Prioritize those features or benefits in your roadmap and listing.

2) Benchmark against competitor metrics

Compare your product’s performance to direct rivals to find what to fix first.

Track review trends – If a competitor’s share is climbing alongside ratings or review volume, plan a targeted push for reviews and post-purchase engagement.

Pinpoint listing weaknesses – Correlate a rival’s sales spike with their listing updates. New images or A+ content driving results for them may be worth testing on your own page.

3) Optimize with competitor keyword data

Reverse-engineer what drives qualified traffic in your niche.

Fill missing keywords – In the Keywords tab, add high-relevance terms your rivals rank for that you do not. Integrate naturally into titles, bullets, description, and A+.

Sharpen PPC – Prioritize competitor-proven keywords in Sponsored Products and defend branded terms. Trim bids on terms that underperform after testing.

Discover new opportunities

1) Find market gaps with review analysis

Let the voice of the customer point to your next product.

Solve recurring problems – If multiple baby carrier reviews mention back pain, design an ergonomic version and position around support and comfort.

2) Use Opportunity Finder alongside Competitive Intelligence

Opportunity Finder surfaces where demand is strong and competition is sane.

Search high-demand, low-competition spaces – Validate winners by building a Competitive Intelligence segment for that niche, then assess top players, pricing bands, and keyword essentials.

Explore related niches – Scan subcategories near your current line, then use Competitive Intelligence to confirm viability before committing.

3) Analyze emerging trends

Use the Overview tab’s 12-month view to see where the market is headed.

Identify category growth – Rising total revenue and units signal a tailwind. Pair with Product Database and Supplier Database to source and launch confidently.

Plan smart expansion – If you manage multiple SKUs, look for adjacent niches with lighter competition and similar buyer needs to expand your catalog efficiently.

Strategic Keyword and PPC Optimization

Competitive Intelligence lets you peek under the hood of your rivals’ search strategy so you can close keyword gaps, aim your PPC at proven converters, and measure your progress against the field.

Use Competitive Intelligence to decide which keywords deserve your listing real estate and ad dollars. Pair it with Keyword Scout and Rank Tracker, and you’ll turn competitor signals into sustained organic rankings and more efficient PPC.

Strategic keyword optimization

1) Analyze competitor keyword performance

Create a competitive segment using your ASIN or a rival’s to map up to 200 close competitors.

Open the Keywords tab to see buckets: Winning, Opportunities, Weak, and Missing.

Prioritize Missing keywords by filtering for higher search volume. These are relevant terms your competitors rank for that you don’t.

Strengthen Weak keywords by weaving them more prominently into titles, bullets, description, and A+ so relevance and rank improve naturally.

2) Leverage multi-ASIN reverse lookup

Use Keyword Scout to run a reverse ASIN on 5–10 top competitors you identified.

Find overlaps across competitors. Repeated terms usually signal the highest intent, highest converting keywords in your niche.

Save and export your shortlist so you can plug them into listings and campaigns without juggling spreadsheets.

3) Refine with Rank Tracker

Track target keywords for you and your pinned competitors over time.

Watch movements to spot when a rival jumps on a term, then investigate what changed.

Adjust and iterate if a keyword stalls: tweak copy, images, or supporting keywords and re-measure.

Strategic PPC optimization

1) Inform bidding with competitor insights

Check suggested bids in Keyword Scout to set realistic budgets and guard against overpaying.

Focus on high-value keywords that Competitive Intelligence and Keyword Scout both flag as relevant and high converting.

Avoid waste by downshifting from pricey, crowded head terms to profitable long tails that still convert.

2) Monitor competitor advertising strategies

Track sponsored ranks in the Keywords tab to see what terms rivals are actively backing with ads.

Find gaps where competitors aren’t bidding and capture cheaper visibility.

Compare sponsored vs organic. If a competitor is propped up by ads on a valuable term but ranks low organically, you can outrun them with better on-page optimization.

3) Read listing changes for ad context

Correlate spikes. When a competitor’s sales jump, check for simultaneous listing updates and a PPC push. That combo often drives the lift.

Use review sentiment in ad copy. If AI Review Analysis shows buyers love a specific benefit, mirror that language in headlines and bullets to raise CTR and relevance.

Jungle Scout Competitive Intelligence FAQ

Jungle Scout Competitive Intelligence is an analytics tool for Amazon sellers and brand owners. It shows how your market works, what competitors are doing, and where you can win more share.

How it works

Create a market segment by entering your ASIN or a competitor’s.

The tool maps up to 200 close competitors based on keyword overlap.

You get a holistic, market-level view instead of tracking only single products.

What data you get

Market share trends – See your share and competitors’ share over time.

Market performance – Total revenue, total units, average price, review volume.

Product comparison – Compare your revenue, price, ratings, and reviews to rivals.

Keyword strategy – See which keywords drive competitor sales and where you can improve organic and PPC.

Review insights – Learn what customers like and dislike about competitor products.

Pricing analysis – Track competitor prices over time to refine your own.

History – Up to 12 months of data to spot trends and seasonality.

Who it’s for

Best for established sellers and brand owners focused on:

Growth – Expanding market share.

Strategic optimization – Tuning pricing, ads, and listings with data.

Decision-making – Choosing what to improve or launch next with clearer market context.

Competitive Intelligence vs Product Tracker

Product Tracker – Monitors specific products you choose.

Competitive Intelligence – Automatically analyzes your broader competitive landscape to show where you stand in the market.

Competitive Intelligence surfaces market-level and product-level data so you can see where you stand, what rivals are doing, and how to improve. You get a complete view of market health, competitor performance, keyword opportunities, and customer sentiment, all in one place.

Market-level data

Market share – How share is distributed and how it changes over time.

Total market revenue – Estimated revenue for the whole segment.

Total units sold – Volume across all products in the segment.

Seasonality – Month-by-month swings to plan inventory and promos.

Individual product (ASIN) data

Revenue and unit sales – Estimates for up to 200 competitor products over 12 months.

Pricing history – Average price trends to spot promo windows and strategy shifts.

Ratings and reviews – Star rating, review count, and review trend lines to see what customers like or dislike.

Keyword data

Revenue-driving keywords – Terms fueling competitor sales and traffic.

Rank comparisons – Your organic and sponsored ranks vs competitors on top keywords.

Sponsored activity – Which keywords competitors buy ads on.

Share of voice – Your visibility vs rivals for specific keywords.

AI-powered insights

AI review analysis – Summaries of common pros and cons from competitor reviews to guide product tweaks and listing improvements.

You can build a segment from one of your own products or from a competitor’s ASIN. Jungle Scout then finds the closest rivals automatically so you can analyze the entire landscape.

Option 1: Create a segment from your connected Amazon account

Click Create Segment in Competitive Intelligence. (You can have up to 20 segments.)

Choose a product from your catalog if your Seller Central is connected.

Name the segment and click Finish.

Option 2: Create a segment from a competitor’s ASIN

Click Create Segment.

Enter the competitor’s ASIN manually.

Name the segment and click Finish.

What happens next

Automatic competitor identification: Jungle Scout analyzes keyword overlap and adds up to 200 of the most relevant competing products to your segment.

Refine your segment

Add or remove ASINs: In the Products tab, include additional products you want to track or remove ones that aren’t relevant.

Pin ASINs: Pin key products so they stay visible across charts and comparisons.

Competitive Intelligence is only available in the Brand Owner + Competitive Intelligence plan.

It’s not included in Starter or Growth Accelerator.

Who this plan is for

Established sellers, brands, and larger teams that need advanced analytics and deeper competitive insights to grow market share.

What this plan adds

Competitive Intelligence tool – Deep competitive and market analysis.

Higher usage limits – Example: Product Tracker up to 2,000 products, Keyword Scout unlimited searches, Rank Tracker up to 5,000 keywords.

More user seats – Access for up to 10 users.

Longer history – Up to 2 years of keyword history and extended product tracking.

Priority onboarding – Faster, guided setup and support.

No third-party tool can deliver 100% exact Amazon sales data because Amazon doesn’t publish it. Jungle Scout uses proprietary models to estimate sales and trends. In practice, its data is widely viewed as reliable estimates you can use for strategy – not precise, audit-ready numbers.

Why it’s considered reliable

Long data history – As an early Amazon research tool, Jungle Scout has had years to refine its models on large datasets.

Strong performance vs competitors – Case studies (in-house and independent) often show Jungle Scout near the top for sales estimate accuracy.

Community validation – Many experienced sellers report its estimates align closely with their real sales.

Known limits

Promotions and stockouts can skew short-term estimates.

BSR is volatile, so single snapshots are noisy.

Best for market-level trends and strategy, not exact ASIN-level counts.

Best Practices

Track over time – Lean on 12 months of history to see true patterns and seasonality.

Watch sustained moves – React to meaningful, persistent changes, not one-off spikes.

Corroborate signals – Pair sales estimates with review trends, keyword movement, and pricing changes before making big decisions.

Competitive Intelligence helps you go beyond “what’s popular” and dig into market dynamics. By reading reviews, tracking share, and watching keyword shifts, you can spot gaps and rising niches before they’re crowded. Use Competitive Intelligence to listen to customers, quantify demand, and verify keyword momentum. You’ll pinpoint where to improve current products and where to place your next product bet with confidence.

Identify underserved market gaps

Analyze review trends with AI Review Analysis to surface common pros and cons across top products.

Action: Turn repeated complaints into feature ideas or quality improvements you can lead with.Evaluate market domination by checking market share trends.

Action: If a few brands control most of the share, look for a neighboring niche. Fragmented share often means easier entry.

Capitalize on emerging trends

Spot seasonality by reviewing market revenue and units over time.

Action: Target categories trending up that aren’t saturated yet, and plan inventory and promos around peak months.Monitor keyword trends in the Keywords tab to see what drives competitor sales.

Action: Prioritize emerging, high-volume, lower-competition terms. Use Opportunity Finder to validate niches built on those keywords.

Optimize within existing niches

Identify competitor weaknesses by comparing pricing, ratings, and reviews.

Action: If demand is high but ratings lag, launch a better-quality alternative and highlight the fix in your listing.Expand your catalog by studying multi-product competitors in your niche.

Action: Map logical add-ons and variants (for a running watch, think heart rate monitors, running headphones, bands) and validate each with Competitive Intelligence data.

No. Competitive Intelligence doesn’t report your own PPC metrics. It’s built to analyze competitors, not manage or measure your internal campaigns. Use Competitive Intelligence as the external intel source, then manage and measure PPC performance in Seller Central and Jungle Scout’s ad-focused tools.

That said, it gives you intel you can use to make smarter PPC decisions.

How Competitive Intelligence helps your PPC strategy

Find keywords driving competitor sales

See which organic and sponsored terms move revenue for rivals.

Action: Add high-value, relevant sponsored keywords you’re missing.Check Share of Voice

View brand visibility on a keyword across organic and sponsored results.

Action: If a competitor dominates a core term, plan more aggressive bids or strengthen organic relevance.Reverse-search competitor ASINs

Reveal the sponsored keywords competitors are likely bidding on.

Action: Fill gaps in your own campaigns with proven terms.

Use these Jungle Scout tools for direct PPC monitoring

Keyword Scout – Search volume, competition, and estimated PPC costs for planning bids.

Rank Tracker – Track your and competitors’ organic vs sponsored positions over time.

Advertising Analytics (with Seller Central connected) – Profitability metrics like ACoS for your actual campaigns.

Start by building one core competitive segment, then use it to benchmark where you stand, spot strengths and gaps, and decide what to do next. Get a clear read on your position before making changes. Build one solid segment, benchmark objectively, then act on pricing, keywords, and product upgrades. Rinse and repeat as you track movement over the next few weeks.

Step 1: Create your core market segment

Open Competitive Intelligence and click Create Segment.

Enter the ASIN of a best-selling product (pick from your catalog if Seller Central is connected, or paste it manually).

In Products, pin your ASIN so it stays visible across charts.

Step 2: Benchmark your performance

Market share trends – See if you’re gaining or losing share vs the segment over time.

Visual Competitive Mapping – Compare your revenue, price, ratings, and reviews to top rivals to understand positioning at a glance.

Seasonality and trends – Use time-series charts to separate market-driven shifts from product-specific issues.

Step 3: Turn insights into an action plan

Pricing – Review 12 months of competitor price moves to set sensible floors and ceilings, time promos, and protect margin.

Keywords & PPC – In Keywords, find revenue-driving and missing terms, check Share of Voice, then:

Improve titles, bullets, and descriptions for organic relevance.

Add high-intent terms to PPC and right-size bids.

Product improvements – Use AI Review Analysis to spot recurring complaints and praised features, then refine materials, features, packaging, or messaging to match what customers want.

Competitive Intelligence is a powerful lens for spotting where to win on Amazon, but it isn’t magic. In practice it shines for strategy and trend spotting, not precision or automation. Before you decide it’s the right fit, keep these tradeoffs in mind:

- Pricing – Only included in the top-tier Brand Owner + Competitive Intelligence plan, so lower plans don’t have access.

- Estimated sales data – Uses modeled estimates (not actual sales). Great for direction, but not 100% precise.

- Segment size limits – Each segment tracks a limited set of ASINs, which may miss some players in broad categories.

- Amazon-only focus – Doesn’t analyze competitors on Shopify, Walmart, eBay, etc.

- BSR sensitivity – Estimates are influenced by BSR, which can be skewed by promos, stockouts, or short-term spikes.

- No direct PPC performance – Shows competitor keyword activity, but your own PPC metrics live in Seller Central or Jungle Scout’s ad tools.

- Hands-on setup – You need to build segments and interpret data regularly to get value.

- Review-based insights – AI Review Analysis depends on the quality and volume of competitor reviews and isn’t a substitute for your own customer research.